The Focus Investment Philosophy for Retail Investors: Unlock Your Potential

Without an approach to investing, you will underperform the market…

As discussed in our previous blog a small underperformance can have a dramatic impact on your returns over the long term.

At this point it is worth committing to an approach. You have 2 high level options:

Option 1: Passively invest and achieve average market returns. This is probably the correct course of action for 90%+ of people. Without an interest in investing your focus is best spent on other endeavours.

Option 2: Commit to becoming a focus investor by:

Taking your financial future into your own hands

Learning and developing yourself into an independent investor

Leveraging the advantages you have to beat the market.

Because you are reading this blog, I presume you are at least interested in option 2. Let’s dig a bit deeper…

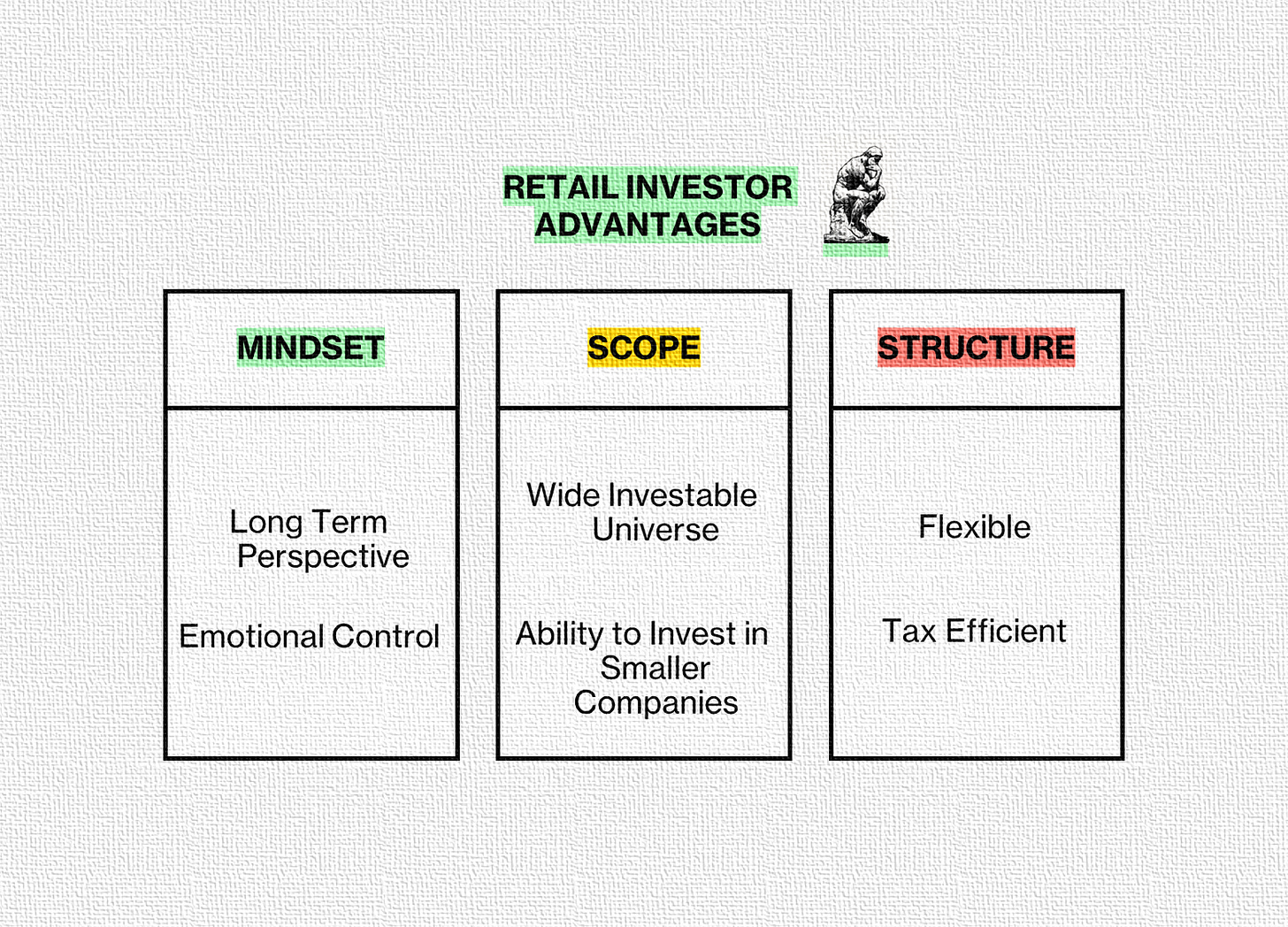

As a reminder to outperform the market you must leverage the advantages you have as a retail investor:

Mindset: Developing the right mindset is crucial. This includes maintaining a long-term perspective, managing emotions, and focusing on the big picture.

Scope: Retail investors have the freedom to explore a wide range of opportunities. This includes investing in small companies and less popular industries or regions, where there is often less competition and more potential for mispricing.

Structure: Retail investors are not bound by the same constraints as professional money managers. This flexibility allows for making bold decisions, taking concentrated positions, and being tax efficient.

To do this however requires an investment philosophy and a process to put that philosophy into action.

The Focus Investment Philosophy

The focus investment philosophy is the approach that I take with my own investments. It has been built from the ground up to fully leverage the MINDSET, SCOPE and STRUCTURE advantages we have as retail investors.

The philosophy acts as the foundation of my investing approach and all decisions are made with this philosophy in mind.

It can be summarised as:

Find high quality businesses with meaning to you 🏆

There are many ways of making money in the market, but we are seeking an approach that leverages the advantages you have as a retail investor, as well as one that will work over the long term to let the magic of compounding take effect.

Quality companies fit this bill.

Our definition of a quality company is one that over the long term consistently generates positive and growing free cash flow per share. It is as simple as that!

The catch is that very few companies actually fit this definition…

The world of business is a competitive place and to grow free cash flow over the long term the business needs a durable competitive advantage.

"The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors." – Warren Buffett

A lot of my time is spent assessing the quality of businesses and make up of their competitive advantages. I will teach you how to do this in future blog posts.

Now coming back to how the philosophy leverages the advantages we have as retail investors.

Remember as a retail investor you have the SCOPE to find business of all sizes, industries and regions. This means you can find high quality business where the professionals are not able or willing to look.

Having the right MINDSET is an essential part of picking companies well. Finding companies with meaning to you means they are within your circle of competence, and you have the deep interest required to fully understand the business.

This sets you up well for making an informed decision when buying the company but also makes it easier to hold for the long term. You are able to truly focus on your investments with this approach.

Buy with conviction when you are getting value 💰

Quality companies are hard to come by.

Harder yet is finding a quality company which is undervalued or even at a fair price.

When you find one of these gems you need to buy with conviction. This means your portfolio should be focused on a small number of companies which you know well and are confident will outperform the market.

There is nothing worse than finding a great company to invest in at an attractive value to then only invest a tiny sum into the business. This can severely limit your upside and the positive impact on your overall portfolio. You will not outperform the market this way.

"The idea of excessive diversification is madness. It's a confession that you don't really understand the businesses that you own." – Charlie Munger

As a retail investor you have the STRUCTURE to buy with conviction so you should take advantage of this. Note: We will discuss appropriate position sizing in future blog posts.

No matter how good a company is it can be a poor investment at the wrong price. Buying overvalued stocks both limits upside potential and increases the risk of loses.

But what do we mean by value? This is best demonstrated through understanding the Price-Value relationship:

Value is the intrinsic value of the company based on its fundamentals. It reflects the company’s real economic value.

Price is the market price at which a company’s stock is trading at on any given day.

Over the long run value and price correlate, over the short term they certainly do not. This leads to opportunities where stocks are mispriced.

We are looking for companies where the market price is equal to or lower than the intrinsic value of the business. The larger the difference the larger the margin of safety on the investment.

To determine this, you need a solid approach to understanding intrinsic value and methods of estimating it. Note: We will discuss valuation methods in future blog posts.

So, you are looking for stocks with a margin of safety and you have the SCOPE to be finding value in places where others are not willing to look.

Cultivate a business owners mindset and hold for the long term ⌛

We are picking businesses not stocks.

This is the most important MINDSET shift that separates winning investors from speculators.

Stocks are not trading cards. They represent a minority stake in a business.

The long-term valuation and total shareholder returns are dependent on the underlying business fundamentals of the company.

Look at the majority of the wealthiest people in the world. They held concentrated positions in quality businesses for the long term:

Jeff Bezos: Amazon

Bill Gates: Microsoft

Bernard Arnault: LVMH

Mark Zuckerberg: Facebook/Meta

They let the magic of compounding take effect!

"If the job has been correctly done when a common stock is purchased, the time to sell it is almost never." - Philip Fisher

To emulate this, you should treat each investment and your portfolio as a whole like a business.

You should aim to treat stocks like a small business owner who owns a 100% stake.

Your focus should be on the intrinsic value of the company and not the price action of the stock.

You should focus on business fundamentals not macroeconomics.

Work on your MINDSET to allow you have the patience to hold for the long term.

The Philosophy as the Foundation

We now have the core of the focus investment philosophy and explained how it leverages the advantages we inherently have as retail investors.

The principles within it act as foundation of the approach domain within the wider Focus Invested Framework. However, you will notice influences from the focus, mindset and practice domains also.

Read more here on the wider focus invested framework:

Going forward, our investment decisions will be grounded in this philosophy and its underlying principles.

In the next blog post we will be exploring the first steps of putting the philosophy into practice through the day in the life of a focus investor.

Disclaimer

As a reader of Focus Invested, you agree with our disclaimer. You can read the full disclaimer here.