Unlocking Market-Beating Returns: Leverage These 3 Advantages

Over the long term the market will make you rich.

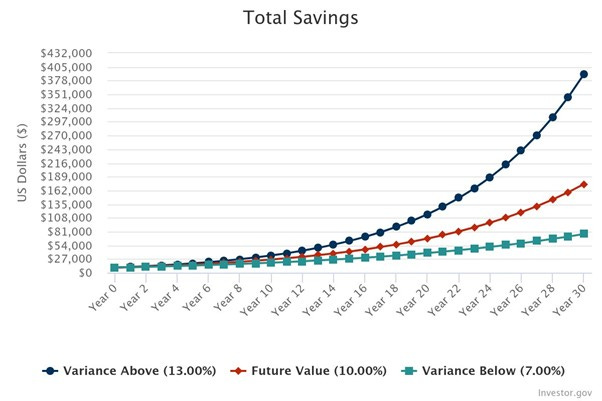

Even with a respectable average return of 10% annually you will more than 17x your money in 30 years.

It is easy to underestimate the impact of small gains. Even a couple of percentage points of outperformance can dramatically improve results over the long term.

As seen below, increasing your rate of return by 3% leads to more than doubling the absolute number equal to a 39x of your original investment. This is the magic of compounding!

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

The most powerful thing you can do when pursuing financial freedom is to achieve market beating results with your investments.

However, beating the market is not just a matter of luck; it requires a focused, disciplined approach.

To do this you need to understand market, the main players and find your own edge to exploit.

What is the market and who are the main players?

When we talk about "the market," we are specifically referring to the stock market. The stock market is a collection of exchanges where investors can buy and sell small shares (Ownership stakes) of publicly traded companies.

Over the long term the performance of the market it dictated by the underlying performance of the companies that make up the market.

The majority of the market's investments are managed by professional money managers through various funds. These funds take one of 2 approaches.

Passive indexing – Passive indexing is a strategy where investors buy a broad market index. Fees are low as there is no active management. Investors can expect to consistently achieve the market average.

Active management: Fund managers actively buying and selling securities in an attempt to outperform the market. Fees for this approach are higher than for passive indexing due to the costs associated with research, analysis and more frequent trading. Investing is a zero-sum game so by definition all the returns of all active managers should equal the average of the return of the market. However, when taking into account fees active managers underperform the market on average. This is balanced by the fact there is also a chance for overperformance…

Beating the market by investing in funds is hard:

Only 17 per cent of actively managed equity funds managed to beat the index over the last decade, according to a new report from Morningstar. Morningstar’s Active/Passive Barometer found that European fund managers are terrible at beating their benchmarks. It analysed over 26,000 funds. - https://www.morningstar.com/en-uk/lp/european-active-passive-barometer

https://www.morningstar.com/en-uk/lp/european-active-passive-barometer

This aligns closely with the Pareto Principle, which suggests that 80 percent of outcomes often come from 20 percent of efforts.

Given the zero-sum nature of the market this means the 20% overperformance is equal and opposite to the 80% underperformance over the long term.

To put it another way, the losses from the 80% are flowing to the 20% of overperformers as gains. (Note: Excluding losses for fees)

The problem for your average investor is how do you consistently pick winning fund managers?

The answer is this is very difficult if not impossible, so the standard advice is to just passively invest.

"The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course." - John C. Bogle, the founder of Vanguard Group and a pioneer of passive investing

This is sensible for the majority of people but what if I told you there is a 3rd option for those who are willing to focus on:

Taking your financial future into your own hands

Learning and developing yourself into an independent investor

Leveraging the advantages you have to beat the market.

But if the majority of professional money managers cannot beat the market. How are we as retail investors supposed too?

How can you compete with all the “smart moneys” MBA’s, resources and time?

The answer is you cannot if you are playng the same game. You need to focus on the advantages you have as a retail investor.

The Advantages you have as a Retail Investor

It is very easy for each of us to list off the advantages that the professional money managers have and write off active retail investing as a not a viable option. They would have you believe that their fancy degrees, ample capital and access to management provide them with an insurmountable edge.

Let’s challenge that assumption…

Fortunately for us, retail investors have some lesser known but hard-hitting advantages.

There are written rules and intrinsic constraints that do not apply to retail investors that make it so we don’t have to play the same game as the “Smart Money”.

Focus on leveraging advantages in each of the 3 following areas to beat the wider market.

MINDSET 🧠

The most important aspect of investing is developing the correct MINDSET and associated behaviours. This is an area that is almost impossible to do optimally when working in the world of professional money management. As Charlie Munger said:

"Show me the incentive and I will show you the outcome."- Charlie Munger

Professional money managers incentives are just not conducive to long term out performance and that is because they are not playing the same game.

Risk Aversion and Career Risk: the most important thing to remember is that money management is a job. The biggest incentive for the money manager is keeping that job and this trumps any over goal such as beating the market. The incentives to take a contrarian view are just not there and leads to behaviours like closet indexing. This is summed up best by the saying "Nobody ever got fired for buying IBM.” This saying reflects the notion that buying well-known, established companies like IBM is seen as a safe choice. Even if the investment does not perform well, the decision is less likely to be criticized because it follows conventional wisdom and industry norms.

Short term focus: Money managers are generally measured on a quarterly basis and therefore they have a lot of incentive to look good in the short term. This leads to following the crowd and buying recent winners that may not necessarily be the best option for long term outperformance.

Bureaucracy in Decision Making: Money managers typically need to go through multiple layers of approval and committees to make decisions. This can mean market beating opportunities are missed and bold innovative ideas can be watered down due to the need for consensus.

Pressure to Conform: We are all social animals and the pressure to conform can lead us to make suboptimal decisions. From an evolutionary standpoint staying with the pack means safety. Operating in a work environment when trying to make decision can make it that much more difficult to control your emotions and make the right choice.

The above can be summarised by the term frequently known as the “Institutional Imperative”.

"Rationality frequently wilts when the institutional imperative comes into play." – Warren Buffet

This is not something we as retail investors are subject to (at least to the same degree!). This is not to say we cannot fall into the trap of our own biases and adopt a suboptimal approach.

The key thing is to focus on developing your MINDSET and leverage the following advantages:

Long Term Perspective: You are investing for the long term and your aim is to outperform the market in the long run. All decisions should be made with this long-term goal in mind. Let the magic of compounding run its course!

Emotional Control: Employ mental models, checklists and have an awareness of common biases. Put yourself in an environment where you are able to execute on your ideas and focus!

SCOPE 🎯

Funds typically have a limited SCOPE in terms of what they can invest in. For example, funds may limit based on location, size and/or industry.

Sometimes these limits are defined with the funds mandate and in others practical considerations limit the number of suitable investments available to them.

Mandated Exclusions: Funds with a specific mandate are by definition excluding a portion of the market from their investable universe. This can work well in some instances as it focuses the analysis on a specific region or industry. However, at times those regions or industries may be falling behind the wider market and the fund manager is limited in what they can invest in.

Small Companies: Dependent on the size of the fund they are managing professional money managers struggle to invest in smaller companies. A fund managing $1 billion dollars is not going to be able to invest in a company of circa $50 million it is just not worth their time. Even I the manager was to purchase 10% of the available stock in the company the company ($5 million) this would be 0.5% of the overall portfolio. Returns here will not move the needle. Purchasing at these levels also adds additional risk in that the shares become less liquid and trying to exit the position quickly could cause issues. This all means that the professional money managers are not looking at smaller companies.

As retail investors we want to take advantage of the fact that we can dictate our own SCOPE. The amount of capital available to us does not prohibit us from investing in smaller companies:

Wide Investable Universe: Remember we are looking for absolute returns and we do not particularly care where they come from as long as we are comfortable with the associated risk. Focus investors should leave their investable universe as wide as possible up front. I will teach you how to properly filter this universe down into a smaller list of suitable investments.

Ability to invest in Smaller Companies: With fund managers not investing in smaller companies there are less eyeballs following the stocks. This means there is less competition and there is more likely to be a mispricing in the valuation of the stock. This is what we are looking for! This combined with the fact that over the long-term smaller companies generally outperform larger companies means that a small cap bias should be incorporated into our portfolio.

STRUCTURE 🏗️

Professional investors are subject to various regulations and fund specific mandates that dictates how they can invest. The very nature of managing money for other people also brings with it some unique challenges. This STRUCTURE limits professional money managers options and flexibility in the following ways:

Position Limits: Most funds have a fairly arbitrary percentage limits on how big any one position within their portfolio can get. In many cases this means that they are unable to let their “winners run” to avoid breaching these limits. This is the complete opposite of what you want to do!

"Some people automatically sell their 'winners' and hold on to their 'losers,' a strategy that's been called 'pulling the flowers and watering the weeds.' You should instead be pruning the weeds and watering the flowers." – Peter Lynch

Capital Outflows and Volatility: Volatility is the enemy of professional money managers. In times of significant drawdowns fund investors will typically withdraw their money and shelter within the perceived safety of cash. These significant capital outflows happen right when the fund should be investing in undervalued assets. This leads to managers attempting to limit volatility on the downside which also has the effect of limiting volatility to the upside!

Significant fees and Taxes: Money managers need to take into account significant fees and taxes when buying and selling. Capital gains tax is a silent drag on returns that adopting a buy and hold approach negates.

Retail investors have the STRUCTURE to be flexible with their decisions and take full advantage of any opportunities that come their way. Leverage the following:

Flexibility: It is your portfolio, and you make the decisions. You can take focused positions in your best ideas, double down when others are bailing out and let your winners run into significant positions within your portfolio. Flexibility combined with the right mindset allows you to make the optimal decision for your portfolio over the long term.

Tax Efficiency: Retail investors can manage their investments in a tax-efficient manner. Take advantage of tax-advantaged accounts (IRAs, Roth IRAs, ISAs, Pensions) and strategically time trades to manage capital gains taxes. This alone can provide you with a couple of percentage points advantage in the long term.

Bringing it together

As you can see from the above there are advantages that us retail investors have that when properly leveraged can provide market beating results.

Unfortunately, most investors are either not aware or don’t have a framework in place to do so.

That is where the focus investment philosophy comes in. This will provide you with the framework to leverage these advantages in practice and will be the subject of our next blog post… (Sneak Peak below!)

Disclaimer

As a reader of Focus Invested, you agree with our disclaimer. You can read the full disclaimer here.