Quality Businesses Part 1: Understanding Shareholder Value Creation

"It’s not timing the market that matters. It’s time in the market, and it’s best to spend that time in the best companies."- Terry Smith

Like Terry Smith a core concept within our investment philosophy is buying quality companies and holding them for the long term.

But what do we mean by “Quality” and why are they the best companies to hold over longer periods?

To explain this, we need to quickly look at how companies create value for their shareholders.

Drivers of shareholder value creation

"The goal of a company is to deliver shareholder value by increasing earnings over time. Earnings growth creates true value." Warren Buffett

The objective of a business should be to maximize shareholder value.

By purchasing a share in the business, you have purchased a portion of the equity of the business and are therefore an owner of the business.

You are entitled to a portion of the value the business provides so you must make sure you understand how the business create value for you!

But what do we mean by value and what factors impact the value a business provides to its shareholders?

At a high level this can be drilled down into 3 key concepts. Remembering these when investigating a business will put you in a position to understand drivers of value and invest accordingly.

Key Concept 1: The value to a shareholder is based on the Cashflows produced by the business

Companies create value for shareholders (equity) and bondholders (debt) by managing capital through the following lifecycle:

Raise Capital: The company borrows capital from debt and equity investors.

Invest and Operate: It uses this capital to pay suppliers, employees, and invest in assets needed to operate and grow.

Generate Revenue: By providing goods and services to customers, the company generates revenue and profit.

Reinvest and Return Capital: The company reinvests in growth opportunities and returns surplus capital to shareholders via dividends and share buybacks, and to bondholders through interest and principal repayment.

In summary companies create additional value for their shareholders by investing cash now to generate more cash in the future!

The value they create is simply the future cash inflows minus the cost of investments made (Surplus capital or cash flow) discounted at an appropriate rate to reflect the present value. The rate at which we discount is based on the cost of capital for the business (See Key Concept 3 for more details on the time value of money and discount rates)

"The cash flow is what drives value. If you don’t have cash flow, you don’t have anything." - Bruce Berkowitz

It is worth pointing out now that anything that doesn’t impact cashflows does not impact value. The classic example is stock splits which neither add or subtract any value to the underlying business.

So, cashflows are important but what factors impact cashflows?

Note: Key Concept 1 is in relation to operating part of the business only which excludes non-operating assets like excess cash and does not consider the impact of debt. A full analysis of how to value a business (including non-operating assets and debt) will be discussed as part of the valuation filter in a future blog post.

Key Concept 2: Value is a function of Return on Invested Capital (ROIC) and Growth

A company’s cash flows, and therefore value of the business, are a function of the Return on Invested Capital (ROIC) and NOPAT / cash flow growth rate (g).

Return on Invested Capital (ROIC): Represents the return a company earns on each dollar invested in the business and is expressed as a %.

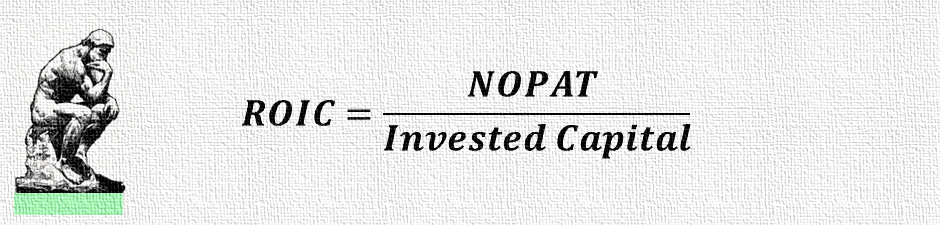

The formula for ROIC is:

Where:

Net Operating Profit After Taxes (NOPAT) is the profits generated from the companies operations after subtracting income taxes.

Invested capital is the cumulative dollar amount the business has invested in its operations. This includes working capital and fixed capital (Property, plant, and equipment)

ROIC is a measure of the efficiency of the business at allocating the capital under its control and therefore how well a company is using its capital to create value for shareholders.

The higher the ROIC of the business the better!

Growth (g): Is the rate at which the company’s NOPAT and cash flow grow each year and is expressed as a percentage.

ROIC and Growth are intrinsically linked. The table below provides an example of a business that is able to maintain a constant ROIC of 15% whilst also reinvesting all profits each year back into the capital of the business.

By doing this the business is also able to grow at a compounded annual growth rate (CAGR) of 15%. This is due to the invested capital of the business growing at 15% due to the reinvestment of profits. It is worth noting that this relationship only holds where businesses have ample reinvestment opportunities at the 15% rate and do not pay any dividends.

From the above it is clear that ROIC and Growth will have an impact on value given the associated increase in Profits and Invested Capital.

By combining ROIC and Growth we can derive the following formula for Value:

This is a somewhat simplified formula which assumes constant growth and a constant ROIC for the business. At this point you do not need to remember this formula and we will revisit this when we discuss company valuation. For now, all you need to remember is the relationship between value, growth and ROIC.

In most cases a higher growth and ROIC will generate more value. There is however a notable exception, and it is related the other term within the formula (WACC) …

Key Concept 3: Value is only created where ROIC is higher than the cost of capital for the business.

As discussed in key concept 1 to value a company we need to discount future cash flows at an appropriate weight to determine their present value.

This is due to the time value of money principle that that states that a sum of money is worth more today than the same sum in the future due to its current potential earning capacity through investment or interest.

"Remember that time is money." Benjamin Franklin

The discount rate is used to account for this by adjusting future cash flows to reflect their present value. It represents the rate of return required to make future cash flows equivalent to current money, factoring in risk and opportunity costs.

But how do we know what rate to discount at?

This is where the weighted average cost of capital (WACC) for the business comes in. WACC represents the minimum return a company needs to earn to satisfy both equity investors and debt holders. It is the company’s cost of capital, considering its capital structure.

WACC accounts for, and is proportionally weighted by, each source of capital (equity and debt) in the company’s capital structure:

Cost of Equity: The return shareholders expect for investing in the company, often calculated using the Capital Asset Pricing Model (CAPM).

Cost of Debt: The interest rate a company pays on its debt, adjusted for tax benefits (since interest payments are tax-deductible).

Companies can alter their WACC by adjusting their capital structure through an increase in debt. Debt is generally cheaper than equity and therefore reduces the overall WACC, but this will also increase financial risk.

Note: We will fully discuss WACC and methods for calculating it as part of the valuation filter in a future blog. For now, we are just interested in understanding the relationship between ROIC and WACC as it is crucial for understanding a company's ability to create value for shareholders.

When ROIC is greater than WACC, the company is generating returns that exceed the cost of its capital. This means the company is creating value for its investors. Conversely, when ROIC is less than WACC, the company is destroying value, as it is not generating enough returns to cover the cost of the capital invested.

This effect is then further amplified by growth!

In the below example we demonstrate the impact on value on a number of different growth and ROIC combinations. In this example we have assumed year 1 earnings of $100, 9% cost of capital, constant growth for 15 years after which all scenarios grow at 4.5%.

Source: Valuation: Measuring and managing the value of companies, McKinsey & Company

The base scenario where ROIC and WACC are equal at 9% then growth has no impact on the net present value of the business which is $1,100 for all growth rates.

It is clear to see that in all scenarios where the ROIC is 7% (Below the 9% WACC/ cost of capital) then any level of growth is value destructive. Increasing growth only destroys more value as more capital is required to maintain the growth which in turn destroys more value.

The opposite is true where ROIC is greater than WACC with growth being value accretive.

From this we can state that it is always better to improve the ROIC of a business. Whereas growth is only good in situations where ROIC is greater than WACC.

High quality companies will have an ROIC significantly larger than their WACC and therefore growth will also be value accretive.

Conclusion

In summary we have discussed 3 key concepts which drive shareholder value:

Key Concept 1: The value to a shareholder is based on the Cashflows produced by the business.

Key Concept 2: Value is a function of Return on Invested Capital (ROIC) and Growth.

Key Concept 3: Value is only created where ROIC is higher than the cost of capital for the business.

By analysing companies with these concepts in mind it is clear that we should look for businesses with both high levels of return on invested capital (Above the cost of capital) and high levels of growth. If we are also confident that these levels of return are durable and can be maintained into the foreseeable future, we are definitely on to a quality business.

Within the next 3 blog posts will document how to find these businesses from both a quantitative and qualitative point of view.

Disclaimer

As a reader of Focus Invested, you agree with our disclaimer. You can read the full disclaimer here.